The Financial Planning Checklist Designed

for Women by Women

Learn more about Strictly Money, my exclusive 10-week online program designed for women to kickstart and magnify your saving & wealth-building journey, down below!

The Only A-Z Online Money Program

Uniquely Designed for Women by Women

MONEY IS PERSONAL

Create your unique financial freedom blueprint with ease and confidence in just 10 weeks, or your money back.

Results YOU can expect!

- You will see your financial confidence and know-how soar and you’ll never again be at the mercy of rigged systems and gender biases that hurt your wealth-building power.

- You will know exactly how to use money effectively as tool to create your dream life of possibilities and impact.

- You will never be emotionally or financially dependent on someone else for your financial security.

Here's what other members are saying...

I had no idea that you needed to start saving for retirement very early to avoid later stress. This opportunity is something that I feel will change my life forever and will eliminate so much financial stress.

I really loved the way you structured the course! What you have done to inspire women to take control of our own finances is truly special.

Here's what's Included

in Strictly Money

-

Money Mindset Foundational Course -

VALUED AT $99 - Saving, Budgeting and Debt Management Strategy Course - VALUED AT $299

-

Financial Life Goals Planning & Strategies (including Retirement Planning)

VALUED AT $299 -

Step by Step Guide to Investing & Building a Portfolio Course -

VALUED AT $599 -

Wealth Protection Planning (Insurance Needs Analysis, Estate & Wills planning) -

VALUED AT $499 -

Resources & Tools Library

- Self-Assessment Guide

- 15 Step by Step Worksheets & Checklists

- 5 Customizable Excel Templates Including:

- Setting Smart Goals & Net Worth

- Save & Spend Plan

- Building Your Investment Portfolio

- Calculating Retirement Funds

- Estate Planning Documents Information List

VALUED AT $399 -

Strictly Money Community Membership -

VALUED AT $399

Total Value: $2,593 USD

This is program is a must for YOU if..

1. You’re not on top of your personal finances and it’s hindering you from achieving more and living big!

2. You’re overwhelmed with conflicting information and financial jargon so you’re not sure if you’re doing enough or doing it right, leaving you confused and frustrated.

3. Time is precious and you don’t want to waste needless time or money getting your financial plan in place.

The biggest myth is that learning the skills to gain financial control is supposed to be hard and time-consuming. Or that women have little control of their financial lives and have to be resigned to accepting their “fate”.

Nothing could be further from the truth!

There are many external factors affecting your ability to take action. I’ll show you how to hack these.

With our proven blueprint and jargon-free online lessons, you’ll be shocked at just how easy it is to learn everything you need to know to be financially happy and thrive.

No one, including you, should feel they have to put their financial fate in someone else’s hands.

Everything you need to take financial control is in this course!

SO WHAT ARE YOU WAITING FOR? LET’S GET ROLLING!

4 Months Free inside the Strictly Money Community Membership

- Continued access to the course

- Access to Private Women's Only Online Community

- Ask Saijal your financial questions directly

- Curation of articles, podcasts, books and media to enhance your financial knowledge

- Members Only Online Events hosted by Saijal

- BONUS: Discounted rates for 1-on-1 coaching with Saijal

Strictly Money Community Love❤️

Course Outline

Strictly Money is a 10-week web-based online program consisting of 5 Modules and 14 lessons.

- Lesson One: The Financial Gender Gap – We unveil the unique challenges women face in building wealth and reveal the innate strengths women have to tap into.

- Lesson Two: Money, It’s Mind Over Matter – You will erase sabotaging money narratives and replace them with powerful ones once and for all.

- Lesson Three: Set & Slay Your Financial Goals – Avoid the most common pitfalls in reaching your financial dreams by learning how to set and slay your goals the right way.

- Lesson Four: Save & Slash Debt – Learn the secret hacks to easily save heaps of money and slash bad debt forever.

- Lesson Five: Planning For Your Retirement – Enjoy a happy and wealthy retirement through our retirement strategy framework.

- Lesson Six: The Case for Investing – Learn the power of investing and why women can’t afford to ignore this key piece of the financial puzzle.

- Lesson Seven: Building Your Investment Portfolio – Create your own unique investment framework aligned to your life goals.

- Lesson Eight: Working With the Financial Industry – Learn the secrets of the financial industry & never be at the mercy of bad advise of expensive products again.

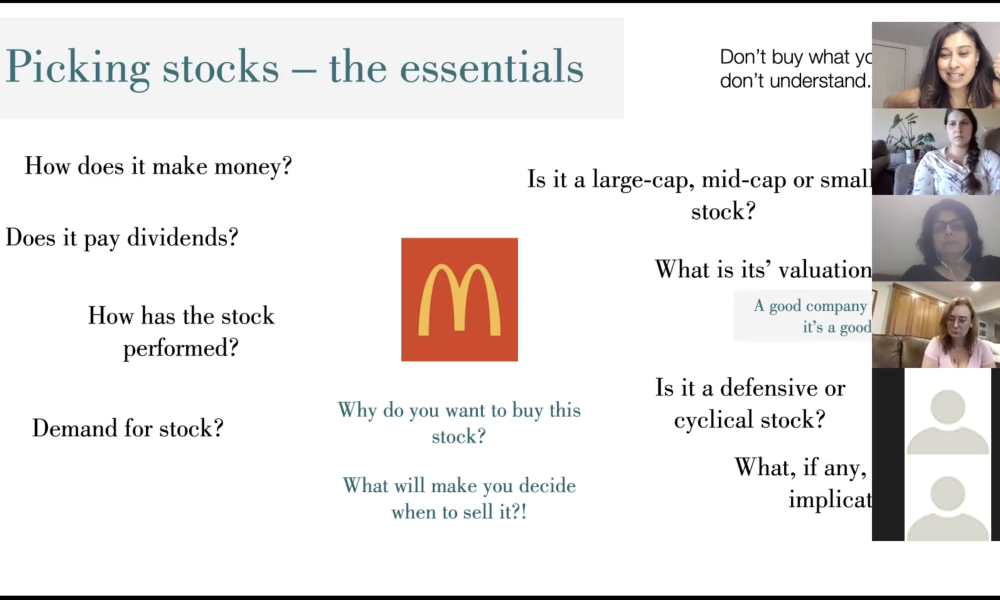

- Lesson Nine: Understanding Stocks – Master how to evaluate stocks and pick the right ones for your portfolio

- Lesson Ten: Understanding Bonds – Learn how to bonds work and their role as an investment

- Lesson Eleven: Mutual Funds vs. ETFs – Learn the pros and cons of mutual funds and ETFs and how to decipher fact sheets.

- Lesson Twelve: Alternatives – Learn the role of alternative investments for creating wealth and managing risk

- Lesson Thirteen: Assurance with Insurance – Protect your wealth from unforeseen circumstances by understanding the role of different insurance solutions.

- Lesson Fourteen: Estate Planning & Wills – Create a legacy of meaning and wealth for your loved ones and avoid the most common mistakes with estate planning.

Invest In Yourself Risk-Free:

You will have access to this 10-week program for 4 months so you can progress at your own pace.

Total Value of Strictly Money is $2,593 USD

Limited Time Only at the Price Below!

Strictly Money

- MONEY MINDSET FOUNDATIONAL COURSE

- SAVING, BUDGETING AND DEBT MANAGEMENT

STRATEGY COURSE - FINANCIAL LIFE GOALS PLANNING & STRATEGIES

- STEP BY STEP GUIDE TO INVESTING COURSE

- WEALTH PROTECTION PLANNING

- RESOURCES & TOOLS LIBRARY

- 4 MONTHS FREE: STRICTLY MONEY COMMUNITY MEMBERSHIP

- BONUS: PRIORITY ACCESS TO 1-ON-1 COACHING WITH SAJI AT 50% DISCOUNTED RATES

- BONUS: ADDITIONAL VIDEOS & ARTICLES TO HELP YOU CREATE MORE SUCCESS!

$25USD refund processing fee will be applied

Meet Your Host

Saij Elle

CFA Charterholder| Award-winning business journalist | Former CNBC/BNN correspondent | Anchor of Strictly Money Tv Show

With more than twenty years’ experience in the financial industry in North America and Asia, as a financial advisor and strategist, Saijal is Chartered Financial Analyst (CFA) Charterholder and a previous accounting practitioner. She works with some of the world’s largest banks to help thousands of their employees and clients (with a special focus on women) to build financial knowledge and confidence.

Saijal is the creator and host of Canada’s only national personal finance show, Strictly Money. She’s a former business anchor and correspondent for Canada’s Business News Network (BNN) and CNBC Asia, and has delivered commentary and analysis on global economies, stock markets and corporate news to more than 300 million households around the world.

Frequently Asked Questions

How do I know this course is for me?

Strictly Money is designed for women who are truly ready to prioritize their financial well-being -properly & holistically; that is…build confidence, save more, cut debt, learn to invest to build wealth, learn how to protect their wealth and/or leave a legacy.

It’s for you if:

You’re tired of spinning your wheels, if you don’t have a ton of time to learn on your own AND are not in a position to spend $4,000 and more on a financial advisor who may or may not meet your needs.

You’re willing to invest in the process and commit 25-30 hours of your time to the program. There are no short-cuts to learning financial skills and putting a plan in place, however the program is designed for maximum learning in minimum time.

You’re ready to check self-judgement and past mistakes at the door – because there’s only going forward and upward, and our membership community is here to encourage you.

The program may not be for you if:

You already have a holistic financial plan in place (investment strategy, retirement plan, estate plan etc.,)

You’re looking to day-trade your investments or gamble with your financial future.

- You’re not willing to put in some work and time.

You want to stay small and comfortable.

I’ve taken a financial course before – how is this different?

We’ve reviewed dozens of courses and have received feedback from women like you on what worked and didn’t and what challenges they had.

That’s why we’ve designed Strictly Money differently.

This program is the only holistic financial program available, taught by Saijal who has 20+ years of in-depth financial experience, so you learn all aspects of managing your money and are properly prepared for the future.

Our aim is to teach women like you the financial skills and know-how so you’re in the top 10% of people with this precious knowledge! You’ll learn more than many financial advisors! Really!

We also recognized that knowledge is not enough. That’s why there are more than enough worksheets to help reinforce takeaways, but also help you to take action.

PLUS, there’s a private community through the membership so that you can get even more support, whilst learning in your own time.

I have debt and little savings, is this course still suitable for me?

Strictly Money covers debt and saving – as it’s an important foundation to building sustainable wealth. But we know to achieve financial freedom, that’s not enough.

That’s why we’re confident that when you tackle these areas, you’ll want to learn about the other important aspects of wealth planning such as how to make sure your investments are working for you to reach your goals, and how to protect your hard-earned money.

I’m a beginner when it comes to personal finance - will the program be too complicated for someone like me?

Our program doesn’t use jargon and complicated terminology that the financial services industry does.

We explain concepts in a relatable way so you can apply them to your unique circumstances. We are confident that you’ll walk away armed with lots of knowledge and ready to take action!

I WANT TO LEARN HOW TO INVEST. HOW WILL THIS Strictly Money HELP ME?

By far investing is the biggest priority for women. That’s why our program has dedicated two entire modules to investing. You’ll learn how to create your own portfolio suited for your life goals, risk tolerance and experience; the key rules to investing; how to evaluate stocks and other assets; how to pick mutual funds and ETFs, and how to decide whether to DIY, use a robo-advisor or find an advisor.

The modules leading up to the investment modules are set up so you learn the important foundation to investing (ignoring these is what gets most people into trouble).

The modules after the investment modules are there so you protect your wealth.

What if I have questions and feel stuck during the course?

The program is designed so you can build the financial know-how without a lot of support.

However, we understand that you may have specific questions, get stuck, need encouragement or even want to share and learn from other like-minded women.

That’s why we encourage you to participate in the private Facebook group through our membership community so Saijal and other participants can support you.

This is also where she’ll post additional content and host live events to help you build on what you learn.

In addition to this, you have the option to set up a 1:1 coaching call (50% discount for members) with Saijal to get confidential support.

What if I don’t like the course?

We don’t want you to be unhappy. If you’re at all unsatisfied with the course, you can reach out within the first 30 days and we’ll give you a refund if less than 40% of the course has been completed.

All refunds will have a $25USD processing fee.

How long do I have to complete the course?

Strictly Money is designed to take 8-10 weeks (25-30 hours) to complete comfortably. However, we know life can get hectic, so once you’ve enrolled in Strictly Money, you’ll have 4 months from the registration date to complete the program.

We want to motivate you to prioritize the program and your finances, plus learn the right tools and building blocks while it’s fairly fresh and top of mind.

Why can't I learn all of this on the internet or from a book?

You absolutely can. You will find thousands of articles on budgeting and investing as well as other topics. There are hundreds of books out there as well.

But this course taps into 20+ years of research and practical experience Saijal has gained through her career and she’s synthesized it into a handful of relentlessly pragmatic and impactful modules so time-starved women like you aren’t wasting energy deciphering through information – of which some may not be credible.

Strictly Money is a time-efficient way of achieving financial mastery and building your unique plan with Saijal supporting you.

Why don’t I get lifetime access?

The program is designed so you learn all the financial essentials and get the support you need to create your unique plan in 8-10 weeks (with extra time provided).

We also wanted to keep the cost of the program reasonable while ensuring you get the results you need. Instead of charging thousands of dollars to cover our program and support costs for lifetime access, we believed a better option was to let enrollees decide how long they want to stay in the program through a low-cost monthly membership model.

What’s the benefit of the membership and community?

Many women have told us the lessons provide a wealth of information, but what’s really catapulting the knowledge and confidence of the hundreds of women in Strictly Money is the community of like-minded women where they can safely ask questions and engage with Saijal and other members, get exclusive content and a curation of articles, podcasts, books and media to enhance their knowledge.

Is this course suitable for women living in different countries?

All the concepts in this course are 90% universal with the exception of certain terminologies, retirement and tax schemes. However, those are important AFTER you’ve learned the foundations of personal finance.

Our Strictly Money enrollees come from different regions of the world – namely the U.S., Australia, New Zealand, U.K, Hong Kong, Singapore & Canada and so we do our best to flag and address different considerations within the course. In addition, we provide targeted information for those in certain countries through the membership community.

have another question?

Get in touch admin@saijelle.com